609 Letter Language:en : 609 Dispute Letter to Credit Bureau Template Examples ... : The 609 dispute letter template.

609 Letter Language:en : 609 Dispute Letter to Credit Bureau Template Examples ... : The 609 dispute letter template.. Providing a written request for proof of your debt that would be difficult or impossible to produce, in theory, prompts the bureaus to delete the negative item. Suppose there is outdated and inaccurate information on your credit report. 609 credit letter template 609 letter template credit disagreement letters. An fcra section 609 letter is not the same thing as a dispute letter. It is a good idea to retain all documentation from certified mailings, correspondence, phone calls, and notes, throughout the entire process.

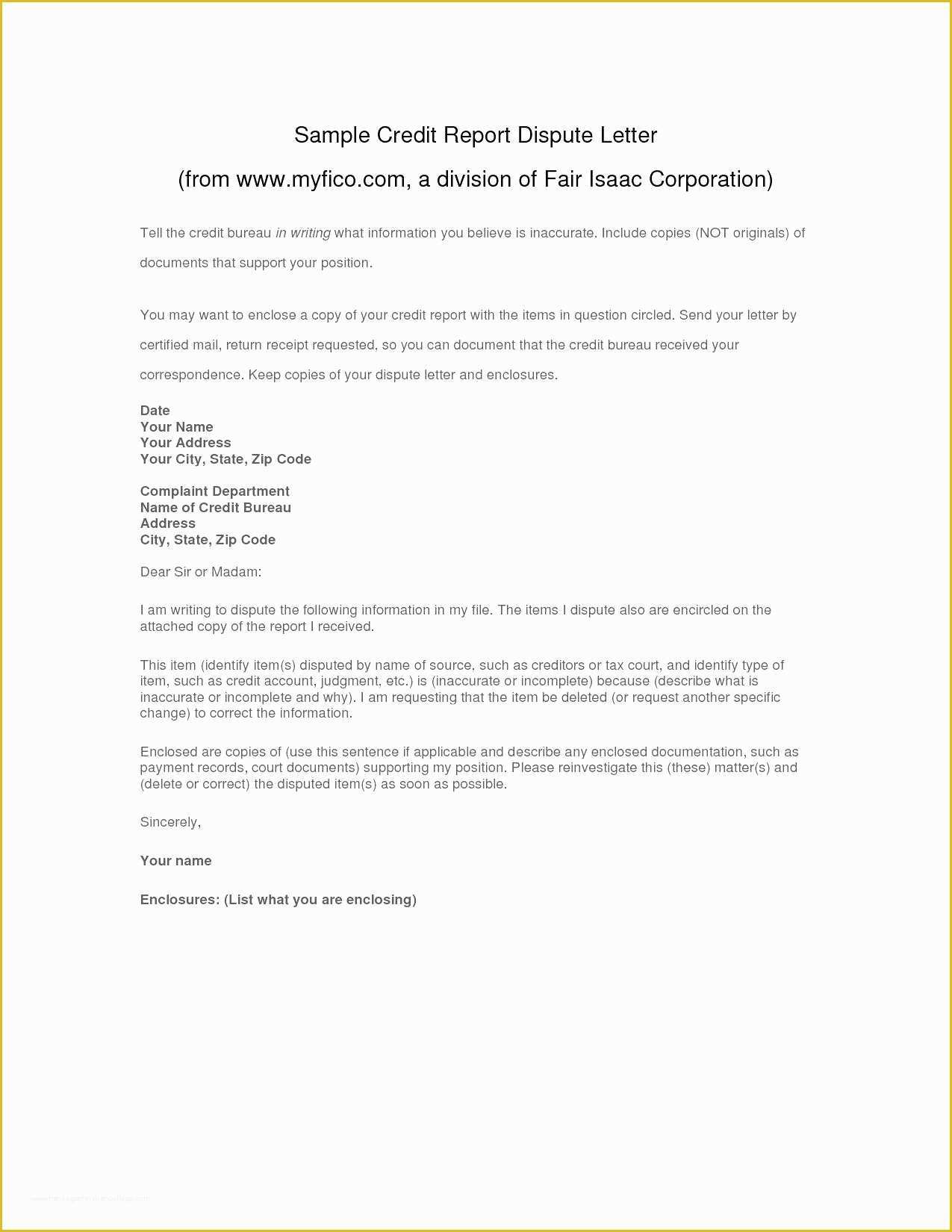

All section 609 credit dispute letters should be sent certified mail to the credit bureau, creditor, or collection agency. The 609 dispute letter requires you to write a letter to the creditor and ask for verification of the information in your file; When writing an official or company letter, presentation design and layout is crucial to earning a good initial impression. What matters is that you include all accounts you want physical verification for, and in a very neat and legible manner.**. Start a free trial now to save yourself time and money!

Get the free 609 letter template pdf form.

609 letters help you take advantage of your right to request information from the data centers. The 609 dispute letter method is based on the notion that credit bureaus must remove any information that cannot be verified. A 609 letter forces credit reporting agencies to investigate and verify any alleged errors on your credit report. This shows whoever is reading your dispute that you know what you're talking about. A 609 letter is simply a letter that you can send to a specific credit bureau to dispute particular parts of your credit report that might have been documented incorrectly. A 609 letter is a method of requesting the removal of negative information (even if it's accurate) from your credit report, thanks to the legal specifications of section 609 of the fair credit reporting act. You are exercising your rights granted by federal law. There's nothing wrong with asking them to do this, by the way; This address must match your driver's license address) city, state zip. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. It is section 609, and the letter is 611 dispute letter which helps the consumer file a dispute to bureaus and get rid of negative items. Get the free 609 letter template pdf form. It's a written request by a consumer to obtain and verify the validity of information found on their credit report.

When writing an official or business letter, presentation design as well as style is essential making a great first impact. It does not generally provide for removal or deletion of inaccurate information. Under the law, they must send you any information in your file about your credit report and any information they have on the account or debt. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. You want to directly cite and quote section 609 in your letter to the credit bureau, reinforcing that it is your right to dispute the items on your report.

Debt collection agencies could add some information to your credit report on your unpaid debts.

Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. 609 letters help you take advantage of your right to request information from the data centers. Co and in section 609 of the fair credit reporting act, it states: A declaration that a customer reporting agency is not required to eliminate precise negative information from the file of a consumer, unless the. The 609 dispute letter method is based on the notion that credit bureaus must remove any information that cannot be verified. A 609 letter, is a letter that is used to request information from the three credit reporting bureaus. Fill out, securely sign, print or email your 609 letter instantly with signnow. Suppose there is outdated and inaccurate information on your credit report. All section 609 credit dispute letters should be sent certified mail to the credit bureau, creditor, or collection agency. You are exercising your rights granted by federal law. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. However, this is not always the case. It makes the credit bureaus disclose all information in your report at your request.

It's a written request by a consumer to obtain and verify the validity of information found on their credit report. Dispute letters templateswritten by janine herrera in collaboration with juan pablodispute letter aggressive credit repair letters section 609 letter round 1 full name address city, state zip credit. A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. Before we dive into the letter please note the addresses for each credit bureau as you will need them for the letter. However, this is not always the case.

In other words, a 609 letter can be a way for you to boost your credit score.

When it comes to the question of whether credit dispute letters are effective, the answer depends on your unique situation. Providing a written request for proof of your debt that would be difficult or impossible to produce, in theory, prompts the bureaus to delete the negative item. Disadvantages of the 609 dispute letter. In general, fcra 609 relates to situations where a consumer is entitled to request and receive information from a cra. When writing an official or business letter, presentation design as well as style is essential making a great first impact. With these and 609 letters you will get fast results. Collection of 609 letter template pdf that will perfectly match your demands. Section 609 of fcra directs or allows the consumer to have copies of their credit reports. The section 609 letters demand inquiry removal, but now you will have 2 letters dedicated to demanding hard inquiry removal for faster results! The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. It does not generally provide for removal or deletion of inaccurate information. Fill out, securely sign, print or email your 609 letter instantly with signnow. It's a written request by a consumer to obtain and verify the validity of information found on their credit report.

Komentar

Posting Komentar